IN SEPTEMBER 2023,

WE CELEBRATE

10 YEARS OF ARDIAN

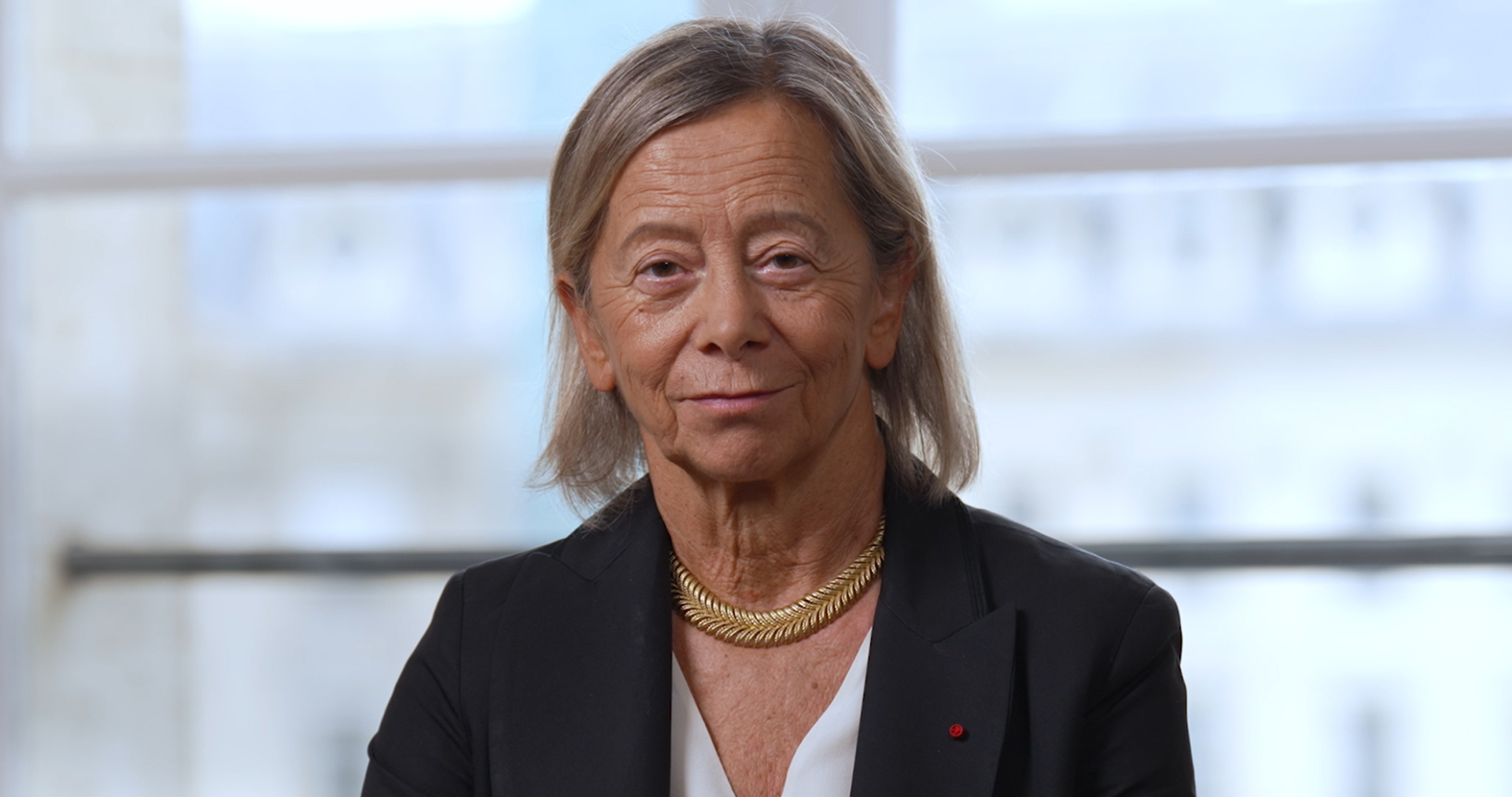

“At Ardian, we invest all of ourselves in

building companies that last.”

Reflecting on Ardian’s 10th anniversary

Founder and CEO Dominique Senequier shares personal thoughts and anecdotes from Ardian’s first decade: the factors that explain the company’s success, the achievements that make her most proud – and the doubters she proved wrong.

Milestones

We started life as AXA Private Equity and in 2013 we became Ardian, a world-leading private investment house. Since then, our growth has accelerated and our story continues to be written.

1996

Creation

Claude Bébéar, Chairman of AXA, asks Dominique Senequier to create a private equity arm for the insurer. AXA Private Equity launches with a $100 million French buyout fund and two external clients.

1997

The company expands steadily into new asset classes and builds its international network.

1999

We open our first international offices in London and New York.

2001

We lay the foundations of our “multilocal” strategy with the opening of the Frankfurt office. Creating seasoned local investment teams in the major European centers has proved a key competitive advantage.

2005

We open our office in Singapore.

2007

We open our Milan office.

2008

Dominique Senequier sets out her vision of value sharing. A pledge is made to share, wherever possible, part of companies’ capital gains on exit with employees of the companies involved. That year we also open our office in Zurich.

2010

The Ardian Foundation is launched by the company’s employees to promote social mobility.

2011

We open our office in Luxembourg.

2012

We open our offices in Beijing and Jersey.

2013

AXA Private Equity becomes Ardian

Dominique Senequier leads employee buyout of AXA Private Equity to create Ardian. At that time, around 80% of employees became shareholders in the company. It sees accelerated growth and puts an increasing focus on sustainability, establishing the Ardian Sustainability Committee.

2015

Growth and acceleration

Ardian is recognized by the UN Principles for Responsible Investment, widely seen as the investment industry’s benchmark in sustainability. That year we open offices in Madrid and San Francisco.

2018

We expand in the Americas and Asia with offices in Santiago, Seoul and Tokyo. The Ardian Women’s Club is created to highlight the voice of women in the private equity industry.

2019

We launch our Sustainability Measurement Methodology for our Buyout activity and expand it to our Expansion activity.

2021

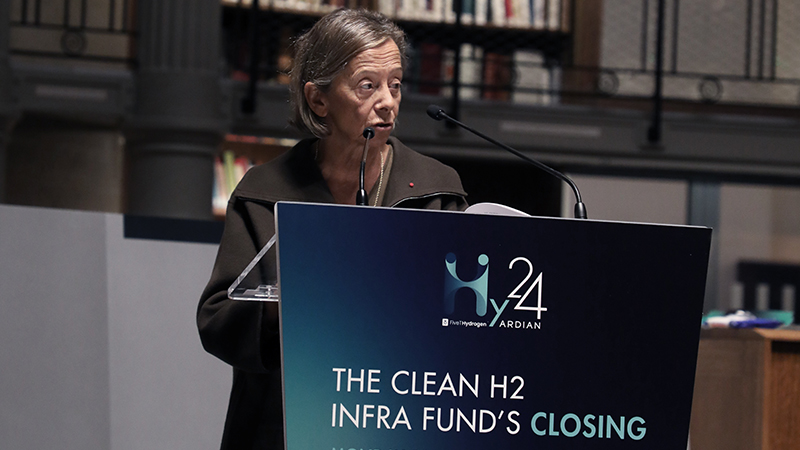

Ardian reaches $125 billion in assets under management, confirming the company’s place among elite private investment houses. This year, Ardian and FiveT Hydrogen launch Hy24, the world’s largest clean hydrogen infrastructure investment platform. Our Inclusion & Diversity Charter is published.

2022

Ardian reaches 1,000 employees and becomes the first European-rooted company to support Ownership Works, demonstrating the company's commitment to promoting employee ownership.

2023

We open our Abu Dhabi office.

1,000+ employees, spread across the world, are strongly committed to the principles of responsible investment and are determined to make finance a force for good in society. Our goal: delivering excellent investment performance combined with high ethical standards and social responsibility.

10 Years, 10 Questions

To celebrate our tenth anniversary, we interviewed three employees from offices around the world to share successes and memorable moments from their time at Ardian – and their vision of the next ten years.

“As a place to work, it approaches perfection.”

Michael Bane, Head of US Investor Relations and Managing Director

“Ardian will continue to surprise us in the next ten years.”

Alexandra Goltsova, Head of Corporate Development and Managing Director

“I’ve grown tremendously at Ardian these past ten years.”

Jason Yao, Head of Greater China and Managing Director

of employees enjoy the quality of their working life

of employees trained in conscious inclusion

joined as interns

entrepreneurial journeys

At Ardian, we help real entrepreneurs to create value. Our decentralized, multilocal structure – having local investment teams based in proximity to entrepreneurs, investors and managers around the world – gives us a true understanding of their needs and of the challenges and opportunities of their businesses. This allows us to support them with a tailored approach to develop their strategy, finance their expansion, and achieve their ambitions.

Towards a carbon neutral future.

A transformational investment opportunity with Nevel

With Nevel’s CEO, Thomas Luther, its Chairman, Eero Auranne, and two of their partners at Ardian: Simo Santavirta and Daniel von der Schulenburg.

14 min 34 secWhen risk management meets growth: in conversation with Optimind

With Christophe Eberlé, CEO of our portfolio company Optimind, and Alexis Saada, Head of Growth and Managing Director at Ardian.

17 min 10 secFrom a memory solutions provider to a leader in cybersecurity, meet our portfolio company Swissbit

With Silvio Muschter, CEO of Swissbit, Ardian’s Dirk Wittneben, Head of Expansion Germany and Yannic Metzger, Director in the Expansion team.

13 min 12 secEuropean growth ambitions for Jakala, the Italian martech leader

With Stefano Pedron, CEO of Jakala and Marco Bellino, Managing Director at Ardian.

15 min 15 secArdian and the architect Franklin Azzi envision the office spaces for tomorrow's real estate assets

With Franklin Azzi, Architect and Stéphanie Bensimon, Head of Real Estate at Ardian.

13 min

Investing for positive impact

Our sustainability strategy is based on three priorities:

Investing in a fairer society

We promote equality of opportunity and collective rewards for collective efforts in Ardian, in our portfolio companies and, through them, in society at large.

We signed the UN’s Principles for Responsible Investment in 2009, becoming one of the first signatories from the private equity industry.

Investing in the climate transition

We reduce our own and our portfolio companies’ carbon emissions and invest in renewables and clean energy technologies.

In 2015, we were a founding member of the Initiative Climat International, a voluntary pledge that commits Ardian and other signatories to recognizing the risks of climate change, integrating climate issues into our investment process, and reducing the greenhouse gas emissions of our majority-owned portfolio companies.

Investing in measurable impact

We support our companies and partners to contribute positively and make the changes that a more sustainable future will demand.

We contribute to a more sustainable future through a variety of mechanisms, such as by positive practices in the way we measure the performance of our portfolio companies, by investing in companies that are unlocking the green technologies of the future, and by leading venture philanthropy projects.of assets managed or advised covered by our 2023 ESG data collection campaign

individualized roadmaps for portfolio companies since 2009 (direct funds)

The Ardian

foundation

The Ardian Foundation was launched in 2010 by the company’s employees. Its mission is to promote social mobility and inclusion for children and young adults from disadvantaged backgrounds. The Foundation focuses most of its work on early childhood as the first years of life are a determining period for the cognitive and emotional development of children. The Foundation operates on a principle of venture philanthropy – that is, using the concepts and techniques of venture capital finance and business management to maximize the impact of its donations and achieve philanthropic goals.

of Ardian employees are directly active in the Foundation

charities in ten countries supported by the Foundation in 2022

deployed by the Foundation in 2022

Ardian around the world:

a global network

From our headquarters in Paris to our newly opened base in the Middle East

Investors’ Location

Americas

Europe

Middle East

Asia-Oceania